ActivTrades is organizing one of the most significant events for traders this year - the Financial Trading Summit. It will take place in Dubai at the Shangri-La Dubai Hotel on 28 October. It will definitely be worth it to attend it as there would be expert traders, speakers and guests from different fields of work and study.

The programme will include discussions on the major pillars in trading such as trading strategies, psychology, risk management, etc. This would be a great opportunity to meet like-minded individuals with the same interests as yours and that's a stepping stone to creating the network of ideas and contacts you need.

I definitely recommend it to anyone who has the opportunity to be there. This will an event you will not forget. In case you need further info, visit Here.

Friday, September 29, 2017

Thursday, September 28, 2017

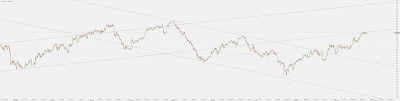

USD/CHF Stops At Upper Trendline

The USD/CHF pair climbed to a 1.5 month high this week as price soared from 0.9425 to a high of 0.9762 yesterday. The latest level marks a multiple top and it is somehow surprising that the level still maintained to keep the bullish camp at bay.

With the recent strengthening of the US dollar, the other currencies are experiencing withdrawals as market participants are loading up on the Greenback. The Euro also suffers depreciation along with the Swiss franc and the Canadian dollar.

As to USD/CHF, if the level of 0.9762 fails to hold, the next bullish obstacle 0.9835. On the other hand, if bears continue to turn the tide, their first target would be 0.9645, second 0.9560 and third target is the major support level at 0.9438.

No major news are expected today except the US GDP which rarely has major impact on the market.

Chart: USD/CHF H4

With the recent strengthening of the US dollar, the other currencies are experiencing withdrawals as market participants are loading up on the Greenback. The Euro also suffers depreciation along with the Swiss franc and the Canadian dollar.

As to USD/CHF, if the level of 0.9762 fails to hold, the next bullish obstacle 0.9835. On the other hand, if bears continue to turn the tide, their first target would be 0.9645, second 0.9560 and third target is the major support level at 0.9438.

No major news are expected today except the US GDP which rarely has major impact on the market.

Chart: USD/CHF H4

Labels:

dollar,

forex,

investing,

rozen,

speculation,

technical analysis,

trade,

trader,

trading,

trend

Wednesday, September 27, 2017

AUD/JPY Shows Losses

AUD/JPY on the daily timeframe shows a fourth day of consecutive losses as bears seem to be taking advantage by high volume and high volatility. Price has recently printed a higher high and has come back for a retracement (HL), this started from the bearish engulfing that formed last week.

Price has currently made its way back to the daily 20EMA, where we are seeing slight buying pressure, with today's daily close. We will be watching to see how today's daily candle closes and to see if price breaks the daily high tomorrow.

If not, we can expect price to reach the 200SMA below 87.50 and react on it. No news are scheduled for today on both sides which implies that we are in for a technical trading day. Having in mind the previous high volatility, uncertainty remains the prevailing market environment in current time.

Chart: AUD/JPY D1

Price has currently made its way back to the daily 20EMA, where we are seeing slight buying pressure, with today's daily close. We will be watching to see how today's daily candle closes and to see if price breaks the daily high tomorrow.

If not, we can expect price to reach the 200SMA below 87.50 and react on it. No news are scheduled for today on both sides which implies that we are in for a technical trading day. Having in mind the previous high volatility, uncertainty remains the prevailing market environment in current time.

Chart: AUD/JPY D1

Tuesday, September 26, 2017

USD/CAD Met Short-term Resistance

USD/CAD was trading to the upside for the past few weeks when price went from 1.2065 to the latest high at 1.24 made yesterday. Today the pair reached the same high at 1.2401 and immediately moved to the downside pressured by USD bulls who want to get to the other end possibly making a double bottom.

The pair went to a low below 1.2360 and is now slightly higher at 1.2372. Today's speech by Fed Chair Janet Yellen might strengthen the change in trend if the news do not meet investors expectations for a strong and stable US economy.

On the flip side, we might see renewed optimism and witness a move beyond the upped trend line with first bear target at 1.2450.

One thing is certain now, eyes will be on the press conference later today.

Chart: USD/CAD H4

The pair went to a low below 1.2360 and is now slightly higher at 1.2372. Today's speech by Fed Chair Janet Yellen might strengthen the change in trend if the news do not meet investors expectations for a strong and stable US economy.

On the flip side, we might see renewed optimism and witness a move beyond the upped trend line with first bear target at 1.2450.

One thing is certain now, eyes will be on the press conference later today.

Chart: USD/CAD H4

Monday, September 25, 2017

EUR/USD Consolidated

On the daily EUR/USD analysis we can see price has been moving bullish since April 2017. We have seen price slowly form higher highs and higher lows.

Recently price has achieved the resistance at the area of 1.20800, where we have seen price rejected. Price has been rejected into a range which has lasted for the last 3 trading weeks. Price is still currently holding above the daily 20EMA and the ascending trendline.

We are currently being patient with this pair for price to show continuation to the upside with a break of the 1.20800 resistance area, or for price to show bearish movement with bearish market structure to the downside.

For a bearish move we would need to see price break the daily 20 & 50 EMA's, ascending trendline and 1.16300 support area. This would open room to the downside.

The weekly candle has closed as a spinning top which does not help with the direction indication. Price is not indicating bullish or bearish, however a new spinning top can be expected due to price being in a sideways range.

Chart: EUR/USD D1

Recently price has achieved the resistance at the area of 1.20800, where we have seen price rejected. Price has been rejected into a range which has lasted for the last 3 trading weeks. Price is still currently holding above the daily 20EMA and the ascending trendline.

We are currently being patient with this pair for price to show continuation to the upside with a break of the 1.20800 resistance area, or for price to show bearish movement with bearish market structure to the downside.

For a bearish move we would need to see price break the daily 20 & 50 EMA's, ascending trendline and 1.16300 support area. This would open room to the downside.

The weekly candle has closed as a spinning top which does not help with the direction indication. Price is not indicating bullish or bearish, however a new spinning top can be expected due to price being in a sideways range.

Chart: EUR/USD D1

Friday, September 22, 2017

UK100 Down

Here is another index chart this time being the UK100 Daily analysis. For some time within this index price had been trapped between the 7448 resistance and the 7300 support which you can see we have highlighted with a arrow.

Price on Thursday last week showed a large bearish move which left price sitting at the 7300 support. This support on Friday last week was broken to the downside with a large bearish candle. Taking a short position is not yet advisable as a break is yet to be confirmed.

Price also broke through the 200EMA, with the 20EMA also crossing bearish with the 50EMA. We are now keeping a close eye on this market for a potential retracement/retest of the 200EMA or the 7300 support turned resistance. The next support within this index is the 7120 area.

Don't forget the speech by Prime Minister May later today. This could create a spark in the stock market and help direct it.

Chart: UK100, D1

Price on Thursday last week showed a large bearish move which left price sitting at the 7300 support. This support on Friday last week was broken to the downside with a large bearish candle. Taking a short position is not yet advisable as a break is yet to be confirmed.

Price also broke through the 200EMA, with the 20EMA also crossing bearish with the 50EMA. We are now keeping a close eye on this market for a potential retracement/retest of the 200EMA or the 7300 support turned resistance. The next support within this index is the 7120 area.

Don't forget the speech by Prime Minister May later today. This could create a spark in the stock market and help direct it.

Chart: UK100, D1

Thursday, September 21, 2017

Germany Moves Up

The Index of Germany has shown signs of strength in the last several days as Germany's stock market is up substantially along with a stronger Euro.We have seen price show a break out of our descending trendline similar to the one in the US30 chart which also led price to break the 12375 resistance.

We did not see a retest of the trendline, however, we are now looking for a retest of the resistance turned support at 12375 for a long position. Over the last 3-4 days last week we saw price show indecision, will could possible lead to the retracement for a retest.

Market participants are now closely observing the Index in order to grasp an idea where is is headed next.. If we are able to take a long position from a retest/retracement then we will look to target the 12825 resistance area. Taking a look at the EMA's we can also see the 20EMA is just crossing over the 50EMA which is another bullish confluence.

Chart: DAX30, D1

We did not see a retest of the trendline, however, we are now looking for a retest of the resistance turned support at 12375 for a long position. Over the last 3-4 days last week we saw price show indecision, will could possible lead to the retracement for a retest.

Market participants are now closely observing the Index in order to grasp an idea where is is headed next.. If we are able to take a long position from a retest/retracement then we will look to target the 12825 resistance area. Taking a look at the EMA's we can also see the 20EMA is just crossing over the 50EMA which is another bullish confluence.

Chart: DAX30, D1

Wednesday, September 20, 2017

US30 At All Time High

The Daily US30 Index Analysis. As you can see recently we have seen a break - retest - continuation of the small descending trendline. Price showed a break and then a retest which was a rejection from the descending trendline and the 50EMA.

This showed confluence at levels that gave price a push back to the upside. We have since seen price show a break above the 21985 resistance with price now heading towards new all time highs at 22366.

If we see a break of the 22366 resistance then we will be looking for price to reach the next area of resistance at 22674. As it's clearly observable market is overall bullish within the US30 Index.

A lot of market experts such as Warren Buffett and Ray Dalio warn about a potential market decline and have either pulled out part of their investments in cash or have hedged against the decline by buying Gold.

Chart: US30, D1

This showed confluence at levels that gave price a push back to the upside. We have since seen price show a break above the 21985 resistance with price now heading towards new all time highs at 22366.

If we see a break of the 22366 resistance then we will be looking for price to reach the next area of resistance at 22674. As it's clearly observable market is overall bullish within the US30 Index.

A lot of market experts such as Warren Buffett and Ray Dalio warn about a potential market decline and have either pulled out part of their investments in cash or have hedged against the decline by buying Gold.

Chart: US30, D1

Tuesday, September 19, 2017

US Dollar Settles In The Lows

Update of the US Dollar analysis on the daily chart. It seems that the index is settling at its recent lows around 11800 - 11 780.

Over the last week we have seen price show a rejection off the -27.2% Fibonacci extension level. Price pushed back up to the 11855 support turned resistance, which aligned with the 20EMA. At this point price printed a bearish engulfing candle which has led price back to the downside.

Price is yet to show a break or rejection from the -27.2% support area, however, a break of this area would open up a big amount of room to the downside which could lead price to the -61.8% extension at 11656.

Today's week has a lot of economic news, most importantly tomorrow's FOMC meeting and Fed Rate decision and this could be an indicator of future direction of the index.

Chart: US Index, D1

Over the last week we have seen price show a rejection off the -27.2% Fibonacci extension level. Price pushed back up to the 11855 support turned resistance, which aligned with the 20EMA. At this point price printed a bearish engulfing candle which has led price back to the downside.

Price is yet to show a break or rejection from the -27.2% support area, however, a break of this area would open up a big amount of room to the downside which could lead price to the -61.8% extension at 11656.

Today's week has a lot of economic news, most importantly tomorrow's FOMC meeting and Fed Rate decision and this could be an indicator of future direction of the index.

Chart: US Index, D1

Monday, September 18, 2017

Economic Calendar For The Week Ahead

The events ahead will give us a clear structure of how the economic machine works worldwide. Of course, the major events will unfold in the United States. We have the FOMC Meeting and Fed Interest rate decision scheduled for Wednesday. On Friday ECB President Mario Draghi will hold a speech on the improvement in the Eurozone.

On Thursday Bank of Japan will release its Policy Statement and that can further depreciate the Yen. The Canadian dollar will be anticipating the release of Core CPI and Core Retail Sales on Friday. UK Prime Minister May will be speaking on Friday which means that the Sterling will also increase in volatility.

The week is packed with nutrition that will give the markets a new momentum. As September comes to an end, market volatility is beginning to catch up.

On Thursday Bank of Japan will release its Policy Statement and that can further depreciate the Yen. The Canadian dollar will be anticipating the release of Core CPI and Core Retail Sales on Friday. UK Prime Minister May will be speaking on Friday which means that the Sterling will also increase in volatility.

The week is packed with nutrition that will give the markets a new momentum. As September comes to an end, market volatility is beginning to catch up.

Friday, September 15, 2017

How To Spot The Trend

You may have heard the saying "the trend is your friend". This is maybe one of the most essential and key elements in trading that you must internalize and implement into your trading style. Every market is trending under any time frame.

The basic understanding is that the longer the time period, the more reliable is the trend. Some people tend to trade in between big trends while others stay with the trend for years.

Whatever you style may be, one thing that can help you advance in your trading success is the trading tool called SmartForecast. It is designed by ActivTrades to help you spot the trend in any market. It is available on the MT4 platform and is very helpful in determining levels of support and resistance.

SmartForecast can increase your level of confidence and bring you good results in return. For more info just visit THIS LINK.

The basic understanding is that the longer the time period, the more reliable is the trend. Some people tend to trade in between big trends while others stay with the trend for years.

Whatever you style may be, one thing that can help you advance in your trading success is the trading tool called SmartForecast. It is designed by ActivTrades to help you spot the trend in any market. It is available on the MT4 platform and is very helpful in determining levels of support and resistance.

SmartForecast can increase your level of confidence and bring you good results in return. For more info just visit THIS LINK.

Thursday, September 14, 2017

USD/CHF Calm

USD/CHF Daily analysis kept simple. Price has now shown a strong close below the 0.94945 support, we would now like to see further continuation to the downside towards 0.93045. A retest of the 0.94945 resistance would warrant a short position.

Bears can take the pair to a low level of 0.9304 as seen on the chart. On the flip side, bulls have the chance to go to 0.9680 and touch the resistance level. If they manage to break it, the way to the upside will be open to the 200SMA.

Tomorrow's US data may very well play a role in developing both scenarios. The US dollar is having a quiet week so far as traders and investors are just getting back on track with their participation in the market.

Chart: USD/CHF D1

Bears can take the pair to a low level of 0.9304 as seen on the chart. On the flip side, bulls have the chance to go to 0.9680 and touch the resistance level. If they manage to break it, the way to the upside will be open to the 200SMA.

Tomorrow's US data may very well play a role in developing both scenarios. The US dollar is having a quiet week so far as traders and investors are just getting back on track with their participation in the market.

Chart: USD/CHF D1

Wednesday, September 13, 2017

DAX Up

Germany30 has been showing signs of strength in its recent performances. This market has recently shown a rejection off the 11845 support, which has given price the bullish push to break through the descending trendline.

Price has also just broken above the 20 & 50 EMA's. Currently, price is back at the 12375 resistance, where patience is advised while watching for a potential break. A break followed by a retest would allow long positions. I would be looking for price to reach back to the 12825 resistance area. On the other hand price could very well show a rejection.

This week would be interesting for all indeces as they started on a positive note on Monday. It seems that with the coming of September, the market has again regained its volatility and excitement.

Chart: DAX D1

Price has also just broken above the 20 & 50 EMA's. Currently, price is back at the 12375 resistance, where patience is advised while watching for a potential break. A break followed by a retest would allow long positions. I would be looking for price to reach back to the 12825 resistance area. On the other hand price could very well show a rejection.

This week would be interesting for all indeces as they started on a positive note on Monday. It seems that with the coming of September, the market has again regained its volatility and excitement.

Chart: DAX D1

Tuesday, September 12, 2017

US Dollar Index Depreciates

An updated view of the US dollar index chart on the daily timeframe. We have recently seen price show a 50.0% Fibonacci retracement, which led price to form a new lower high flowing with the downtrend market structure.

Price has since slowly made its way further bearish after rejections from the 20EMA, we did see slight choppiness until price broke the 11855 support. Since price broke the 11855 support price has run predominantly bearish creating a new daily lower low.

We have seen price achieve the -27.2% Fibonacci extension level at 11768. Last weeks weekly candle has closed strongly bearish after several spinning tops. It seems that market participants are now looking for price within the US Dollar to continue bearish, which means further dollar weakness.

Chart: US Dollar Index, D1

Price has since slowly made its way further bearish after rejections from the 20EMA, we did see slight choppiness until price broke the 11855 support. Since price broke the 11855 support price has run predominantly bearish creating a new daily lower low.

We have seen price achieve the -27.2% Fibonacci extension level at 11768. Last weeks weekly candle has closed strongly bearish after several spinning tops. It seems that market participants are now looking for price within the US Dollar to continue bearish, which means further dollar weakness.

Chart: US Dollar Index, D1

Monday, September 11, 2017

GBP/AUD Close to Resistance

The British Pound is having a day in the green today as the UK currency is moving up against all its peers. GBP/AUD was trading around 1.6350 in the opening hours of the first session of the week and is now up substantially to a high of 1.6430. The pair is currently trading at 1.6424.

The move up does not seem fatigued as the pair is now very close to the resistance level of 1.6455. The level is seen as short term resistance for the pair and if it is taken out, next major bull target is expected at 1.6740. For this to happen, the Sterling has to receive a lot of support both fundamentally and technically.

Around the level of 1.67 lays the 200SMA which would be another obstacle in the bulls' way. On the way down, bears have their targets at 1. 6120, 1.6000 and 1.5800.

Chart: GBP/AUD H4

Friday, September 8, 2017

Silver at Resistance

Silver is now trading at $17.90 meeting with the resistance at $18.00. The precious metal is still hesitating and it is clear that bears are trying to put it down at current level. The strong resistance comes at a point where the US dollar is not selling with such rapid speed as before indicating that investors and traders are trying to pile up on it and drive the price up.

Silver, on the other hand, is feeling the effect of a steady dollar and has temporarily ended its advancement from $15.11 to $18.00 in three months. Silver would need to break the resistance and close above $18.00 if bulls want to keep on enjoying the rally.

No major US news are expected this week so we might continue to see Silver trading sideways before something new happens that could create a stir and give a hint of the probably direction of the precious metal.

Chart: XAG/USD H4

Silver, on the other hand, is feeling the effect of a steady dollar and has temporarily ended its advancement from $15.11 to $18.00 in three months. Silver would need to break the resistance and close above $18.00 if bulls want to keep on enjoying the rally.

No major US news are expected this week so we might continue to see Silver trading sideways before something new happens that could create a stir and give a hint of the probably direction of the precious metal.

Chart: XAG/USD H4

Thursday, September 7, 2017

EUR/USD Slightly Up Before ECB

The Euro is trading a bit higher anticipating the interest rate decision of the ECB later today. The expected rate is to remain unchanged at 0.00%. Nevertheless, that could still drive the price of the Euro up substantially given that after the announcement, ECB President Mario Draghi will deliver a speech on the economic and political conditions currently prevailing in the European Union.

Price is now 1.1970, up from today's low of 1.1917. First bullish resistance is expected to be met at the last major high of 1.2070. In case we hear an alarming message from the ECB President, market participants might turn their capital to the US dollar and depreciate the pair's price to first bear target at 1.1860.

The ECB Press Conference will be a key event that could direct the European currency for the whole month of September. If we get a clear strong message that Europe is doing well, then the Euro might continue on its course to be the single most appreciated currency for the year of 2017.

Chart: EUR/USD H4

Price is now 1.1970, up from today's low of 1.1917. First bullish resistance is expected to be met at the last major high of 1.2070. In case we hear an alarming message from the ECB President, market participants might turn their capital to the US dollar and depreciate the pair's price to first bear target at 1.1860.

The ECB Press Conference will be a key event that could direct the European currency for the whole month of September. If we get a clear strong message that Europe is doing well, then the Euro might continue on its course to be the single most appreciated currency for the year of 2017.

Chart: EUR/USD H4

Wednesday, September 6, 2017

Gold Keeping Up With Gains

Gold has been rallying since mid-July this year as the US dollar has been depreciating. Market participants continue to flock to the safe haven asset amid global political uncertainty and geopolitical tensions caused by North Korea.

The precious metal reached a high $1,344 in the early trading hours today and is now trading slightly below that level at $1,340 with a low of $1,335. Almost a year high (last one was Sep 22), the $1,344 level will meet serious resistance if the geopolitical tension loosens up. First major resistance is spotted at $1,350 which would be a touch on the upper long term trend line starting from Gold's low point of $1,122 on Dec 22 last year.

Whatever the case may be, Gold is again showing signs of strength as hedge fund legends as Ray Dalio continue to point out that every investor needs to own Gold in such perilous times as these.

Chart: XAU/USD H4

The precious metal reached a high $1,344 in the early trading hours today and is now trading slightly below that level at $1,340 with a low of $1,335. Almost a year high (last one was Sep 22), the $1,344 level will meet serious resistance if the geopolitical tension loosens up. First major resistance is spotted at $1,350 which would be a touch on the upper long term trend line starting from Gold's low point of $1,122 on Dec 22 last year.

Whatever the case may be, Gold is again showing signs of strength as hedge fund legends as Ray Dalio continue to point out that every investor needs to own Gold in such perilous times as these.

Chart: XAU/USD H4

Tuesday, September 5, 2017

Will the Euro Continue Rallying in September?

The Euro is definitely having its best year for at least 5 years of trading history. The single European currency has significantly increased its worth against the US dollar going from a low of 1.03 to a high of 1.20 in exactly 8 months, starting from January until August.

September brings us with the expectations that with the summer closing in, market participants will dive again into trading and create new opportunities. This means that we can certainly expect higher volatility. What we cannot be sure, however, is will the Euro keep going.

The latest rally came without any serious corrections, implying that the move will still continue to the upside. What we can tell for sure is that the pair is well above the 200SMA and is holding up very well above the upper trendline resistance-turned-support.

Chart: EUR/USD D1

September brings us with the expectations that with the summer closing in, market participants will dive again into trading and create new opportunities. This means that we can certainly expect higher volatility. What we cannot be sure, however, is will the Euro keep going.

The latest rally came without any serious corrections, implying that the move will still continue to the upside. What we can tell for sure is that the pair is well above the 200SMA and is holding up very well above the upper trendline resistance-turned-support.

Chart: EUR/USD D1

Labels:

dollar,

EU,

euro,

eurusd,

forex,

fundamental analysis,

investing,

rozen,

speculation,

technical analysis,

trade,

trader,

trading,

trend

Monday, September 4, 2017

Gold Opens with a Gap

Gold opened the trading session with a gap of about $10 jumping from $1,322 to opening price of slightly above $1,332. The reason for the gap open is the weekend geopolitical tension created by North Korea. The continuation of missile launches directed to targets in Japan's sea is raising concerns amid the political scene. World leaders are calling for provocation to stop. South Korea says it expects further missile launches, Russia and Japan are calling for North Korea to stick to the UN resolutions and Trump is threatening with a massive and effective military response.

All of this creates uncertainty. And in the midst of uncertainty Gold thrives. If these tensions continue to spell dark clouds we might see Gold break the barrier of $1,400 this month.

So far today Gold reached a high of $1,339 and is now trading at $1,333. More hedge funds pile Gold into their portfolio as major currencies are seeing some outflows of capital.

Chart: XAU/USD D1

All of this creates uncertainty. And in the midst of uncertainty Gold thrives. If these tensions continue to spell dark clouds we might see Gold break the barrier of $1,400 this month.

So far today Gold reached a high of $1,339 and is now trading at $1,333. More hedge funds pile Gold into their portfolio as major currencies are seeing some outflows of capital.

Chart: XAU/USD D1

Labels:

analysis,

chart,

currencies,

dollar,

forex,

gold,

investing,

rozen,

speculation,

technical analysis,

trade,

trader,

trading,

trend

Friday, September 1, 2017

SmartCalculator by ActivTrades | Master the Risk

Risk management is seen as one of the most, if not the most, important elements in trading. As any successful trader knows, preserving your capital is crucial to your survival in markets. This is why ActivTrades offers its clients a very useful and helpful solution for every trader, regardless of their level of experience.

The free tool is called SmartCalculator and it does a number of good things. You can calculate your expected return by setting a Take profit order and the allowed loss by setting a Stop loss order.

Basically, you write down your capital, choose a leverage and base currency and then enter the trade info - instrument, lots (goes to 0.01) and the position side - buy or sell. Then you insert open price, TP and SL and the system shows you important data as Pip value, potential gain and loss etc. It's definitely worth checking, for those interested just go HERE.

The free tool is called SmartCalculator and it does a number of good things. You can calculate your expected return by setting a Take profit order and the allowed loss by setting a Stop loss order.

Basically, you write down your capital, choose a leverage and base currency and then enter the trade info - instrument, lots (goes to 0.01) and the position side - buy or sell. Then you insert open price, TP and SL and the system shows you important data as Pip value, potential gain and loss etc. It's definitely worth checking, for those interested just go HERE.

Labels:

activtrades,

investing,

rozen,

speculation,

trade,

trader,

trading,

trend

Subscribe to:

Posts (Atom)