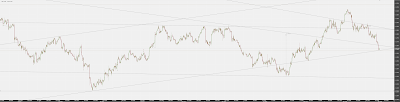

The precious metal is now trading at $1,317 after a slide off the opening level of $1,325. Gold's decline of more than $10 is the results of North Korea's follow through their statement to end nuclear pursuit for US truce.

The trust between South Korea and North Korea jumped after feel-good summit at which their leaders declared an end to hostilities and to work toward denuclearization of the peninsula.

The Gold market was used as a safe haven in the past month and now as tensions ease off, traders and investors seem to feel confident to own national currencies instead of locking their capital in Gold.

If the sell of continues, first bear target and bullish attempt to bounce off would be the level of $1,305 - $1,300.

Chart: XAU/USD H4

Monday, April 30, 2018

USD/CHF Breaks Resistance

The USD/CHF exchange rate has gone significantly higher over the past two months. The pair registered a rise from 0.9180 to 0.9920 which was reached in the opening hourse of the US session of Friday.

Currently, USD/CHF is hovering slightly below 0.9900 at 0.9889. The US dollar seems to be flashing signs of a possible continuation of an upward move. Considering how strong the upside momentum is, we could expect the pair to reach new resistance at 0.9970 and then the psychological level of parity at 1.00.

Today's fundamentals are negligible so we could expect trading to be based on technical patterns and light volatility.

Chart: USD/CHF H4

Currently, USD/CHF is hovering slightly below 0.9900 at 0.9889. The US dollar seems to be flashing signs of a possible continuation of an upward move. Considering how strong the upside momentum is, we could expect the pair to reach new resistance at 0.9970 and then the psychological level of parity at 1.00.

Today's fundamentals are negligible so we could expect trading to be based on technical patterns and light volatility.

Chart: USD/CHF H4

Friday, April 27, 2018

Spread Betting by ActivTrades

ActivTrades is offering Spread Betting as one of their main services. The service includes multiple instruments to choose from, small capital boosted by leverage to provide larger positions and tax-free profits for UK residents.

The service includes Forex, Indices & Fixed income, Commodities and Shares. By signing up you get access to all of those markets everywhere you go by using the online trading platform which allows you to trade on the go with your PC, Tablet or Smartphone.

Some of the advantages are fast execution, automated trading at hand, Metatrader 4 and 5 and more.

If you want to give it a try, just hop on their website HERE and learn more about the opportunity!

The service includes Forex, Indices & Fixed income, Commodities and Shares. By signing up you get access to all of those markets everywhere you go by using the online trading platform which allows you to trade on the go with your PC, Tablet or Smartphone.

Some of the advantages are fast execution, automated trading at hand, Metatrader 4 and 5 and more.

If you want to give it a try, just hop on their website HERE and learn more about the opportunity!

Wednesday, April 25, 2018

EUR/AUD Higher

The EUR/AUD exchange rate is trading higher today after briefly touching the 50SMA a few days ago. The pair is now well above the most important moving averages, namely 50, 100 and 200. Market participants will most likely try and push the pair to first level of resistance at 1.6250.

Bears could attempt to bring it down to their long term goal at 1.36. Major milestones before that level are 1.54, which coincides with the 200SMA and 1.44 which makes a double bottom with the same low in mid July 2017.

The pair is now consolidated around 1.60 to 1.61 and will most likely break out when there is a significant fundamental reason.

Chart: EUR/AUD D1

Bears could attempt to bring it down to their long term goal at 1.36. Major milestones before that level are 1.54, which coincides with the 200SMA and 1.44 which makes a double bottom with the same low in mid July 2017.

The pair is now consolidated around 1.60 to 1.61 and will most likely break out when there is a significant fundamental reason.

Chart: EUR/AUD D1

EUR/NZD Uptrend

The EUR/NZD exchange rate has been seeing massive support over the past couple of weeks. The currency pair appreciated from a low of 1.6700 to today's highest high at 1.7180. Main trend on the medium term is strongly bullish with a low of 1.4550 and long term trend remains in consolidation spanned from 1.4550 to 1.7480.

On the short term scale, we could see the pair go to the resistance level at 1.74 where bears could attempt to bring it down and keep it under the resistance line that could validate the down trend move started in september 2015.

On the other hand, if bulls are able to win the fight, EUR/NZD could break the 1.74 mark and eye the next level of resistance at 1.76.

Chart: EUR/NZD D1

On the short term scale, we could see the pair go to the resistance level at 1.74 where bears could attempt to bring it down and keep it under the resistance line that could validate the down trend move started in september 2015.

On the other hand, if bulls are able to win the fight, EUR/NZD could break the 1.74 mark and eye the next level of resistance at 1.76.

Chart: EUR/NZD D1

Labels:

forex,

rozen,

speculation,

technical analysis,

trade,

trader,

trading,

trend

Tuesday, April 24, 2018

Gold Slightly Higher

Gold is trading higher in today's session after the precious market sold off as a reaction to the announcement that North Korea has agreed to cease their missile tests. Before this announcement, Gold bugs hopped on the train in anticipation that something bad might happen between the USA and North Korea.

However, as tensions eased up Gold saw a massive outflow of capital resulting in the depreciation from a high of $1,355 to a low of $1,321.

Currently, Gold is trading somewhere around $1,326, marking a slight improvement in bullish sentiment.

Major bull target is to break the resistance at $1,360 and close above it so that they could end the medium term downtrend and the short term consolidation in the range of $1,360 and $1,305.

Chart: XAU/USD H4

However, as tensions eased up Gold saw a massive outflow of capital resulting in the depreciation from a high of $1,355 to a low of $1,321.

Currently, Gold is trading somewhere around $1,326, marking a slight improvement in bullish sentiment.

Major bull target is to break the resistance at $1,360 and close above it so that they could end the medium term downtrend and the short term consolidation in the range of $1,360 and $1,305.

Chart: XAU/USD H4

Bitcoin On The Move

As the cryptocurrency market is recovering, Bitcoin is again taking the lead as one of the most appreciated assets in this asset class, the cryptocurrency industry. Bitcoin dived below the 200SMA giving birth to rumors that the whole market is crashing only to recover and to bring back positivity into the space.

Bitcoin dived under $6,500 to a low of $6,440 and is now trading at $9,200 less than three weeks after the bottom.

According to Dan Morehead, founder and CEO of Pantera Capital, one of the largest cryptocurrency hedge funds, Bitcoin flashed a rare buy signal when it went below the 200SMA.

The cryptocurrency market is the newest asset class in more than a decade. No one actually knows if it will stick around, but if it does, it would be well worth it to invest in it now.

Chart: BTC/USD H4

Bitcoin dived under $6,500 to a low of $6,440 and is now trading at $9,200 less than three weeks after the bottom.

According to Dan Morehead, founder and CEO of Pantera Capital, one of the largest cryptocurrency hedge funds, Bitcoin flashed a rare buy signal when it went below the 200SMA.

The cryptocurrency market is the newest asset class in more than a decade. No one actually knows if it will stick around, but if it does, it would be well worth it to invest in it now.

Chart: BTC/USD H4

Thursday, April 19, 2018

EUR/CHF Moves Up

The Euro is moving up against its continental counterpart - the Swiss Franc. The exchange rate has been going in a steady and consistent uptrend ever since the SNB decided to unpeg the Swiss franc against the Euro.

On January 2015 the EUR/CHF went from 1.20 to 0.84 in a matter of a single day. The second day after the SNB decision, the Euro started to appreciate against the CHF and today we are just a few pips shy of the pre-decision level of 1.20.

Today, the EUR/CHF exchange rate reached 1.1993 and is currently trading at 1.1986. The pair is expected to reach 1.20 today. After that, it is unknown what the market participants will do. They might either boost the progression beyond the previous peg level or bring it down below in an attempt to short the Euro and long the Swiss Franc.

Chart: EUR/CHF D1

On January 2015 the EUR/CHF went from 1.20 to 0.84 in a matter of a single day. The second day after the SNB decision, the Euro started to appreciate against the CHF and today we are just a few pips shy of the pre-decision level of 1.20.

Today, the EUR/CHF exchange rate reached 1.1993 and is currently trading at 1.1986. The pair is expected to reach 1.20 today. After that, it is unknown what the market participants will do. They might either boost the progression beyond the previous peg level or bring it down below in an attempt to short the Euro and long the Swiss Franc.

Chart: EUR/CHF D1

Wednesday, April 18, 2018

Gold Consolidates

Gold has been trading in the area of $1,340-$1,345 for the past few days as market participants anticipate the outcome of the Syrian conflict and newly occurred political issues coming out of the USA.

If there is no development, Gold bugs will be disappointed as there is a chance traders and investors will dump their Gold holdings and allocate their capital elsewhere. In this case, we will be looking at prices hovering around $1,320 - $1,300.

If the situation worsens, however, we will witness a massive surge to the precious metal with targets anywhere above $1,360 which would invalidate the triple top formation and pave the way for Gold at $1,400.

Chart: XAU/USD H4

If there is no development, Gold bugs will be disappointed as there is a chance traders and investors will dump their Gold holdings and allocate their capital elsewhere. In this case, we will be looking at prices hovering around $1,320 - $1,300.

If the situation worsens, however, we will witness a massive surge to the precious metal with targets anywhere above $1,360 which would invalidate the triple top formation and pave the way for Gold at $1,400.

Chart: XAU/USD H4

Labels:

forex,

fundamental analysis,

gold,

investing,

rozen,

speculation,

trade,

trader,

trading,

trend

USD/CHF Pushes Higher

The USD/CHF pair is having a period of appreciation that started on Feb 16 and has been going on since then. The uptrend started at 0.9185 at its lowest and now the pair just made a new high at 0.9700.

Double top was taken out yesterday when the pair made a short timeout from its climb and sustained the trading at 0.9665-0.9670. This morning the exchange rate pierced the formation and climbed to the new high thus exposing the way to the next bull target at 0.9780.

If that level is reached we can expect the bears to take control and bring down the rate, otherwise bulls might get a new momentum if we see positive US data later this week.

Chart: USD/CHF H4

Double top was taken out yesterday when the pair made a short timeout from its climb and sustained the trading at 0.9665-0.9670. This morning the exchange rate pierced the formation and climbed to the new high thus exposing the way to the next bull target at 0.9780.

If that level is reached we can expect the bears to take control and bring down the rate, otherwise bulls might get a new momentum if we see positive US data later this week.

Chart: USD/CHF H4

Monday, April 16, 2018

USD/CHF Closing in On 200SMA

The USD/CHF exchange rate has been going up for the last couple of months from a low of 0.92 to a high of 0.9630. The currency pair is in an unbroken uptrend already past the 50- and the 100-SMA and is now closing in on the 200-SMA at 0.9660.

By technical indications it looks like the pair will reach the target this week. If this happens, we could see a reversal from the uptrend thus turning the direction of the pair in the other way with first bear target at 0.9520.

If the US bulls are strong enough to break through the resistance at 0.9660 we could see a renewed optimism in the market with major bull target at 0.9820.

Chart: USD/CHF D1

By technical indications it looks like the pair will reach the target this week. If this happens, we could see a reversal from the uptrend thus turning the direction of the pair in the other way with first bear target at 0.9520.

If the US bulls are strong enough to break through the resistance at 0.9660 we could see a renewed optimism in the market with major bull target at 0.9820.

Chart: USD/CHF D1

Gold Goes Down

Gold continued its way South this morning after an abrupt military conflict between the US and Syria. Some analysts expected that the price of Gold will rise higher due to the uncertainty caused by the US attack on Syrian grounds.

However, Gold seemed to be unbothered by the developments and is now trading at $1,341, down from $1,348 opening price.

If the conflict is left to dry out and rumors cease, we could see further depreciation of the yellow meta to potential first target at $1,327, which aligns with the 50SMA, next target is the 100SMA $1,314 and the third target is the 200SMA at $1,299.

Chart: XAU/USD D1

However, Gold seemed to be unbothered by the developments and is now trading at $1,341, down from $1,348 opening price.

If the conflict is left to dry out and rumors cease, we could see further depreciation of the yellow meta to potential first target at $1,327, which aligns with the 50SMA, next target is the 100SMA $1,314 and the third target is the 200SMA at $1,299.

Chart: XAU/USD D1

Friday, April 13, 2018

ActivTrades' Benefits

Every trader needs to do their due diligence prior to starting their investment and trading work. In today's globally connected world we are able to select any broker we want out of hundreds and hundreds of choices all around the world.

Therefore, it's important for every trader to carefully research the brokers field and choose which broker would best suit their needs.

What you need to look for is a broker that offers a wide variety of markets, platform availability on multiple devices, mobile, desktop, tablet and of course security and protection of funds.

This is where ActivTrades steps in as a safe and trustworthy choice. They offer all of the above plus a friendly and fast interface, add-ons to help improve your effectiveness, learning and education through webinars and seminar and also several withdrawal options.

Definitely check them out if you are looking to open an account with a new broker or you need a change from your current one. For more info, visit HERE.

Therefore, it's important for every trader to carefully research the brokers field and choose which broker would best suit their needs.

What you need to look for is a broker that offers a wide variety of markets, platform availability on multiple devices, mobile, desktop, tablet and of course security and protection of funds.

This is where ActivTrades steps in as a safe and trustworthy choice. They offer all of the above plus a friendly and fast interface, add-ons to help improve your effectiveness, learning and education through webinars and seminar and also several withdrawal options.

Definitely check them out if you are looking to open an account with a new broker or you need a change from your current one. For more info, visit HERE.

Gold Takes a Breather

Following a massive surge earlier this week, bears have maintained their dominance in the market since late Wednesday. The yellow metal fell 1.41% against the Greenback during the previous session and breached the 55– and 100-hour SMAs.

Its subsequent support level, set by the 23.60% Fibo retracement and the 200-hour SMA, was not surpassed, thus leaving the rate near the 1,340.00 mark this morning.

Technical indicators remain bullish, suggesting that this cluster could remain intact. In addition, the pair is likely to be hindered near the 55-hour SMA and, if surpassed, no additional resistance barriers until 1,360.00 are located in between. By and large, this session might not introduce significant volatility in the market, as no fundamental data releases are scheduled.

Chart: XAU/USD H4

Its subsequent support level, set by the 23.60% Fibo retracement and the 200-hour SMA, was not surpassed, thus leaving the rate near the 1,340.00 mark this morning.

Technical indicators remain bullish, suggesting that this cluster could remain intact. In addition, the pair is likely to be hindered near the 55-hour SMA and, if surpassed, no additional resistance barriers until 1,360.00 are located in between. By and large, this session might not introduce significant volatility in the market, as no fundamental data releases are scheduled.

Chart: XAU/USD H4

Wednesday, April 11, 2018

USD/CAD at Support

The USD/CAD exchange rate continues to depreciate on Wednesday but with considerably lower volatility than the previous sessions. However, the pair still managed to breach the lower boundary of a dotted trend-line.

Given that a breakout had occurred through the bottom border of a dominant descending channel, the US Dollar could target a support level formed by the weekly support at 1.2488.

On the other hand, bulls might try to introduce a slight upside potential within this session. Nevertheless, technical indicators demonstrate that the aforementioned downside target could be fulfilled during the next 24 hours.

Chart: USD/CAD H4

Given that a breakout had occurred through the bottom border of a dominant descending channel, the US Dollar could target a support level formed by the weekly support at 1.2488.

On the other hand, bulls might try to introduce a slight upside potential within this session. Nevertheless, technical indicators demonstrate that the aforementioned downside target could be fulfilled during the next 24 hours.

Chart: USD/CAD H4

Labels:

dollar,

forex,

speculation,

technical analysis,

trade,

trader,

trading,

trend

NZD/USD Makes a New High

The New Zealand Dollar continues its neat journey in an ascending channel against the US dollar. By the end of US session on Tuesday, the pair has reached a new one-month high at 0.7390.

During the first part of Wednesday's trading, the currency pair made a brief corrective move south but the decline encountered a support formed by the monthly pivot point at 0.7353.

Everything being equal, the NZD/USD currency exchange rate is likely to continue moving north until it finds resistance set by the weekly resistance at 0.7390. In the meantime, technical indicators favor bull to grow stronger within this trading day.

Main resistance on the medium term is seen at 0.7505, while main support is seen at the 200SMA at 0.7180.

Chart: NZD/USD D1

During the first part of Wednesday's trading, the currency pair made a brief corrective move south but the decline encountered a support formed by the monthly pivot point at 0.7353.

Everything being equal, the NZD/USD currency exchange rate is likely to continue moving north until it finds resistance set by the weekly resistance at 0.7390. In the meantime, technical indicators favor bull to grow stronger within this trading day.

Main resistance on the medium term is seen at 0.7505, while main support is seen at the 200SMA at 0.7180.

Chart: NZD/USD D1

Tuesday, April 10, 2018

NZD/USD Moves To The Upside

Bulls continue their dominance over the NZD/USD pair. The currency pair has breached the weekly resistance at 0.7331 and has also tested the upper boundary of a dominant ascending channel.

A strong support cluster set by the combination of the 55– and 100– hour simple moving averages allowed the Kiwi bulls to grow stronger during the end of the US session on Monday.

Given that the dominant pattern has been breached to the upside, it is likely that the New Zealand Dollar would continue to strengthen against the Greenback during the following session. In addition, technical indicators favor the rally to continue until it finds resistance at the next resistance near 0.7390.

Chart: NZD/USD H4

A strong support cluster set by the combination of the 55– and 100– hour simple moving averages allowed the Kiwi bulls to grow stronger during the end of the US session on Monday.

Given that the dominant pattern has been breached to the upside, it is likely that the New Zealand Dollar would continue to strengthen against the Greenback during the following session. In addition, technical indicators favor the rally to continue until it finds resistance at the next resistance near 0.7390.

Chart: NZD/USD H4

Thursday, April 5, 2018

Gold Sell Off

The first part of Wednesday's trading session was spent in a calm manner, as the yellow metal was moving along the 55-hour SMA. A strong surge mid-session pushed the pair 0.94% higher towards its one-week high of 1,348.00.

These gains, however, failed to remain for long, as the prevalence of strong downside risks resulted in a plunge back down to the monthly pivot point and the senior channel at 1,330.00. Technical indicators demonstrate that this bearish sentiment could allay during the following hours, thus allowing for a slight recovery.

Gains are likely to be limited due to the massive resistance cluster formed by the 55-, 100– and 200-hour SMAs and the 23.60% Fibo located near 1,337.00. This area might eventually be breached during the remaining part of this trading week.

Big impact on the price could occur tomorrow when the US NFP's and jobs data will be released.

Chart: XAU/USD H4

These gains, however, failed to remain for long, as the prevalence of strong downside risks resulted in a plunge back down to the monthly pivot point and the senior channel at 1,330.00. Technical indicators demonstrate that this bearish sentiment could allay during the following hours, thus allowing for a slight recovery.

Gains are likely to be limited due to the massive resistance cluster formed by the 55-, 100– and 200-hour SMAs and the 23.60% Fibo located near 1,337.00. This area might eventually be breached during the remaining part of this trading week.

Big impact on the price could occur tomorrow when the US NFP's and jobs data will be released.

Chart: XAU/USD H4

Tuesday, April 3, 2018

EUR/JPY Falling

The European single currency has failed to gain strength against the Japanese Yen, thus lingering slightly above a support cluster set by the combination of the weekly and the monthly pivot points near 130.81.

The 200-hour simple moving average has been providing support for the EUR/JPY currency pair for the last three consecutive trading session. by the middle of Monday's session, the exchange rate was consolidating due to lack of traders in the market.

Everything being equal, the currency exchange rate is likely to remain calm today due to the Easter Monday holiday. Strong support level rests at 128.80. We can expect bearish momentum to continue until positive EU data is released or the pair visits the medium term support.

Chart: EUR/JPY H4

The 200-hour simple moving average has been providing support for the EUR/JPY currency pair for the last three consecutive trading session. by the middle of Monday's session, the exchange rate was consolidating due to lack of traders in the market.

Everything being equal, the currency exchange rate is likely to remain calm today due to the Easter Monday holiday. Strong support level rests at 128.80. We can expect bearish momentum to continue until positive EU data is released or the pair visits the medium term support.

Chart: EUR/JPY H4

AUD/USD Bearish

Bearish sentiment dominated the AUD/USD currency pair on Friday. However, a new junior ascending channel has been spotted. The pair tested the lower boundary of the junior pattern during the Asian session on Monday.

By the middle of the European trading session on Monday, the exchange rate has breached both the 55– and 100– hour simple moving averages and was gradually moving north for a test of the weekly pivot point at 0.7694.

Technical indicators flash strong bearish signals. This might suggest that the currency exchange rate could drop lower today until it breaches the bottom border of the junior channel. Strong support level rests at 0.7620.

Chart: AUD/USD H4

By the middle of the European trading session on Monday, the exchange rate has breached both the 55– and 100– hour simple moving averages and was gradually moving north for a test of the weekly pivot point at 0.7694.

Technical indicators flash strong bearish signals. This might suggest that the currency exchange rate could drop lower today until it breaches the bottom border of the junior channel. Strong support level rests at 0.7620.

Chart: AUD/USD H4

Monday, April 2, 2018

USD/CAD at Resistance

The 200– hour simple moving average has guided the US Dollar down against the Canadian Dollar. The pair has formed a triangle like a pattern as it can be observed on the chart.

The recent weakness for the Buck was caused by trade discoursed between China and the United States which has weighed heavily on the currency pair for the past two weeks. Due to this reason, the USD/CAD pair has breached a support cluster set by the weekly pivot point and both the 55– and the 100-hour SMAs near 1.2885.

The pair is looking to find immediate support at around 1.2860 as it is now laying at the resistance at 1.2920. Currently, the exchange rate hovers at 1.2914.

Chart: USD/CAD H1

The recent weakness for the Buck was caused by trade discoursed between China and the United States which has weighed heavily on the currency pair for the past two weeks. Due to this reason, the USD/CAD pair has breached a support cluster set by the weekly pivot point and both the 55– and the 100-hour SMAs near 1.2885.

The pair is looking to find immediate support at around 1.2860 as it is now laying at the resistance at 1.2920. Currently, the exchange rate hovers at 1.2914.

Chart: USD/CAD H1

NZD/USD Consolidated

The New Zealand Dollar remained stable against the US Dollar during Monday's trading session. A gradual bullish momentum continues to dominate the currency pair.

During the European trading session on Monday, the NZD/USD exchange rate was bouncing between 0.7250 and 0.7220. The combination of the 100– and 200– hour simple moving averages was providing resistance for the price, while the level around 0.7200 is supporting the price.

In the meantime, technical indicators flash strong sell signals. However, traders are waiting for the ISM Manufacturing PMI release which is scheduled at 14:00 GMT today. This news could result in volatile market swings and thus impacting the pair in either way.

Chart: NZD/USD H4

During the European trading session on Monday, the NZD/USD exchange rate was bouncing between 0.7250 and 0.7220. The combination of the 100– and 200– hour simple moving averages was providing resistance for the price, while the level around 0.7200 is supporting the price.

In the meantime, technical indicators flash strong sell signals. However, traders are waiting for the ISM Manufacturing PMI release which is scheduled at 14:00 GMT today. This news could result in volatile market swings and thus impacting the pair in either way.

Chart: NZD/USD H4

Subscribe to:

Posts (Atom)