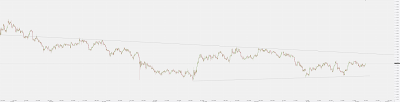

EUR/USD has been consolidating around 1.06 for the past few days. It seems that nothing is strong enough to drive the market participants in either directions. The pair made a high of 1.06289 today and is now back towards the 1.06 level.

If the price continues to consolidate we might see a loss of interest and a bearish takeover with first short-term target at 1.0522. Lower than that we might be heading towards parity, given that the Trump administration continues to boost market expectations.

On the other hand, if we get bad economic data this week from the US, Euro bulls will use the opportunity to push price higher to a possible first target at 1.0680.

Chart: EUR/USD H4

Tuesday, February 28, 2017

Monday, February 27, 2017

Gold at Resistance

Gold is trading at resistance today reaching a high of $1,258. The precious metal is having a good rally that started in the middle of December last year when price was $1,122. Although the big players such as George Soros and John Paulson ditched Gold last month on rumors that the Trump tidal wave will continue, the precious metal keeps rallying to new highs.

Price reached multi-month high on Friday when Gold touched $1,260, which also happens to be the 200SMA. The latest high marks the resistance in the medium-term outlook. Bulls, however, look determined to get over it as expectations for a strong 2017 for Gold continue.

If market closes above $1,260 today we would have a clear indication that current market price will be left behind. If price closes below $1,260 today, then it would be best to sell with tight stop or to wait for more certain times to buy in.

Chart: XAU/USD D1

Price reached multi-month high on Friday when Gold touched $1,260, which also happens to be the 200SMA. The latest high marks the resistance in the medium-term outlook. Bulls, however, look determined to get over it as expectations for a strong 2017 for Gold continue.

If market closes above $1,260 today we would have a clear indication that current market price will be left behind. If price closes below $1,260 today, then it would be best to sell with tight stop or to wait for more certain times to buy in.

Chart: XAU/USD D1

Wednesday, February 22, 2017

EUR/USD Below Support

EUR/USD is trading below support in the preopening hours of the European session. The pair is now 1.0522 as it went below the support at 1.0540 yesterday. Euro bulls now have the task to bring the price up from current level which also happens to be a non-validated double bottom on the short-term. If they succeed, then price should be back in the uptrend channel sooner than later.

On the other hand, market participants are taking into consideration the upcoming FOMC minutes later today and that could have a drastic impact on the market, more specifically, the EUR/USD pair.

Until then, market could continue to gravitate towards current levels. Major support rests at 1.0440, while major resistance is located at 1.0720.

Chart: EUR/USD H4

On the other hand, market participants are taking into consideration the upcoming FOMC minutes later today and that could have a drastic impact on the market, more specifically, the EUR/USD pair.

Until then, market could continue to gravitate towards current levels. Major support rests at 1.0440, while major resistance is located at 1.0720.

Chart: EUR/USD H4

Tuesday, February 21, 2017

Gold Moves Lower

Gold bugs are having a time out today as the precious metal is decreasing in price due to a sharp upward move in the US dollar. Gold reached a low of $1,227 and is now trading at $1,230. Although the precious metal is down today, the bullish move remains intact.

Gold started to appreciate when it reached a low of $1,121 in December last year and went as high as $1,244 just a few days ago in the beginning of February this year.

Market sentiment remains bullish and we can expect the momentum to keep pushing the price up to a possible first target of $1,250, second important price level is the 200SMA which falls on $1,260 and major bull target is seen at $1,380.

On the other hand, if bears take control, price is expected to revisit first support at $1,200, second at $1,180 and third and major support at $1,130.

Chart: XAU/USD D1

Gold started to appreciate when it reached a low of $1,121 in December last year and went as high as $1,244 just a few days ago in the beginning of February this year.

Market sentiment remains bullish and we can expect the momentum to keep pushing the price up to a possible first target of $1,250, second important price level is the 200SMA which falls on $1,260 and major bull target is seen at $1,380.

On the other hand, if bears take control, price is expected to revisit first support at $1,200, second at $1,180 and third and major support at $1,130.

Chart: XAU/USD D1

Labels:

chart,

commodities,

commodity,

dollar,

forex,

gold,

investing,

rozen,

speculation,

technical analysis,

trader,

trading,

trend

Silver Down

Silver is trading to the downside in today's session. The precious metal reached a low of 17.83 as an intraday low and is now trading at 17.88. Main trend on the short-term remains bullish and today's depreciation might be regarded as a correction before the move continues higher.

A factor that could be in favor of the continuation of the bullish move is the 200SMA and more specifically the fact that current market price is being supported by it. If price manages to stay above the 200SMA we might see improved bullish confidence in the metal and witness a move higher.

First bull target is seen at 18.50, major bull target is 19.80.

Chart: XAG/USD D1

A factor that could be in favor of the continuation of the bullish move is the 200SMA and more specifically the fact that current market price is being supported by it. If price manages to stay above the 200SMA we might see improved bullish confidence in the metal and witness a move higher.

First bull target is seen at 18.50, major bull target is 19.80.

Chart: XAG/USD D1

Labels:

chart,

commodities,

commodity,

forex,

investing,

rozen,

silver,

speculation,

technical analysis,

trade,

trader,

trading,

trend

Monday, February 20, 2017

USD/PLN Higher

USD/PLN is trading to the upside since the beginning of February this year with price going from 3.9776 to a high of 4.0877. The pair is in a bull rally due to weak Polish fundamentals and respectively strong data coming from the US. Dollar bulls may try to bring it up to a first target at 4.1122. In that case, they would have to go through immediate resistance at 4.08.

On the other hand, Polish bulls have a slight advantage in current market environment due to the immediate resistance and weak volumes. They could push it down to major target of 3.9300. Bears have to go through a few support levels namely 4.0370, 3,9740.

The long-term trend remains bullish, the short-term is still bearish until we can get above 4.2800.

Chart: USD/PLN H4

On the other hand, Polish bulls have a slight advantage in current market environment due to the immediate resistance and weak volumes. They could push it down to major target of 3.9300. Bears have to go through a few support levels namely 4.0370, 3,9740.

The long-term trend remains bullish, the short-term is still bearish until we can get above 4.2800.

Chart: USD/PLN H4

Labels:

chart,

currencies,

dollar,

forex,

investing,

rozen,

speculation,

technical analysis,

trade,

trader,

trading,

trend

GBP/NZD Consolidating

GBP/NZD opened the European session higher in comparison to last weeks levels. The pair reached an intraday high at current market price of 1.7372 and is now facing immediate resistance. The Sterling had a bad week last week when it depreciated against major opponents.

Now, the British currency appears to be gaining trust again. GBP/NZD is reacting bullishly to market conditions and now eyes are on first resistance level at 1.7480. Major bull target rests at 1.7710.

On the other hand, Sterling bears might attempt to bring it down below last week's level and close at 1.72. Major bear target is seen at 1.6895.

Chart: GBP/NZD H4

Now, the British currency appears to be gaining trust again. GBP/NZD is reacting bullishly to market conditions and now eyes are on first resistance level at 1.7480. Major bull target rests at 1.7710.

On the other hand, Sterling bears might attempt to bring it down below last week's level and close at 1.72. Major bear target is seen at 1.6895.

Chart: GBP/NZD H4

Friday, February 17, 2017

Spotting Price Reversal Within Trending Markets | Webinar Review

Spotting market reversals is regarded as one of the most significant and essential elements that define a successful trading style. In light of this, ActivTrades hosted a free webinar. Dr Andrew Lumsden-Groom, Chief Academic Officer for the House of Trading, presented a webinar on Wednesday, Feb 15. The webinar discussed how to use key price levels that we can use in order to define the market direction in volatile trending markets.

Moreover, the webinar also touched on how to use the Fibonacci price ratios and levels for a successful approach to any market.

The presented information was accompanied by charting analysis and insightful advice, helpful for any trader.

In case you missed the webinar, you can find it here - Webinars Archive.

To keep pace with all upcoming webinars, visit The Webinars Page.

Moreover, the webinar also touched on how to use the Fibonacci price ratios and levels for a successful approach to any market.

The presented information was accompanied by charting analysis and insightful advice, helpful for any trader.

In case you missed the webinar, you can find it here - Webinars Archive.

To keep pace with all upcoming webinars, visit The Webinars Page.

Thursday, February 16, 2017

USD/JPY Met Resistance

USD/JPY continued to trade in the descending channel on the short-term outlook. The pair registered a high of 114.92 earlier this week and is now trading at 113.70. The downtrend appears to be intact as market participants chose to follow the pattern and stay in the channel.

In light of this, if the scenario plays out, we should see the pair reach the lower line of the channel before long. What would aid the process is negative US fundamentals. If the fundamentals are in favor of the pattern, price should reach below 112.00.

On the other hand, US dollar bulls are ready to take it higher with the support of positive fundamentals. Until the end of the week, no major news are scheduled, except the US initial jobless claims that would be released tomorrow.

Chart: USD/JPY H4

In light of this, if the scenario plays out, we should see the pair reach the lower line of the channel before long. What would aid the process is negative US fundamentals. If the fundamentals are in favor of the pattern, price should reach below 112.00.

On the other hand, US dollar bulls are ready to take it higher with the support of positive fundamentals. Until the end of the week, no major news are scheduled, except the US initial jobless claims that would be released tomorrow.

Chart: USD/JPY H4

Wednesday, February 15, 2017

US Equities Higher On Yellen Speech

Fed Chair Janet Yellen made a statement yesterday that FED policy makers don't need to wait on Trump's tax cuts in order to raise rates. She also made the announcement that there would be three raise rates this year, the first could be expected in March.

The speech gave the markets a wake up call as bonds sold off and US equities rallied to new highs.Dow Jones reached 20,535 and the S&P reached 2,338.

The hawkish attitude towards the market could be regarded as concerning to the risk management in infrastructure spending, tax reduction and Trump's policy implementations.

Yellen will be questioned today on House Committee.

The speech gave the markets a wake up call as bonds sold off and US equities rallied to new highs.Dow Jones reached 20,535 and the S&P reached 2,338.

The hawkish attitude towards the market could be regarded as concerning to the risk management in infrastructure spending, tax reduction and Trump's policy implementations.

Yellen will be questioned today on House Committee.

Tuesday, February 14, 2017

CAD/JPY Consolidation Continues

CAD/JPY is trading right about between resistance and support in the shot-term outlook. The pair registered a move to the upside in the beginning of the month and has now reached immediate resistance in the face of 87.00

Short-term resistance is seen at prior highs at 88.80, while short-term support awaits at 84.78, the two latest lows.

The pair is expected to continue trading in that range due to low volatility and fundamentals. During the consolidation period, market participants would most probably wait for a break out of either sides before making their decision. However, the predominant trend is bullish with strong resistance at 89.00.

Chart: CAD/JPY H4

Short-term resistance is seen at prior highs at 88.80, while short-term support awaits at 84.78, the two latest lows.

The pair is expected to continue trading in that range due to low volatility and fundamentals. During the consolidation period, market participants would most probably wait for a break out of either sides before making their decision. However, the predominant trend is bullish with strong resistance at 89.00.

Chart: CAD/JPY H4

Monday, February 13, 2017

USD/JPY Mid-way

USD/JPY is in the middle of its downward short-term trend in today's preopen European hours. The pair is now 113.68 and is caught between support at 112.00 and resistance at 115.00. The trend shows that the pair progressively weakens and therefore we can expect the resistance to change the direction back from the correction wave to the downside.

However, we should not undermine market's strength amid strong US expectations and so, USD/JPY can make an attempt to go above short-term resistance and reach mid-term resistance at 118.60.

We don't have any major news scheduled for today, but the next two days are packed with financials such as Chair Yellen's speech before senate on Tuesday and the Consumer Price Index on Wednesday.

Chart: USD/JPY H4

However, we should not undermine market's strength amid strong US expectations and so, USD/JPY can make an attempt to go above short-term resistance and reach mid-term resistance at 118.60.

We don't have any major news scheduled for today, but the next two days are packed with financials such as Chair Yellen's speech before senate on Tuesday and the Consumer Price Index on Wednesday.

Chart: USD/JPY H4

Wednesday, February 8, 2017

USD/CAD Slightly Up

USD/CAD is trading to the upside in today early European hours. The pair has been in a steady upward move since the beginning of the month and appears to be currently on hold waiting for market movers.

The pair posted some gains today but they were short lived as the US dollar could not go above yesterday's high of 1.3211. USD/CAD is now trading at 1.3171 faced with first resistance level at 1.3211, second level is seen at 1.3383 and major resistance is seen at 1.3600.

Main trend continues to be bearish on the long-term but if bulls get good indications for a potential appreciation of the US dollar, the pair will embark on its upward journey supported by strong US financials.

Chart: USD/CAD H4

The pair posted some gains today but they were short lived as the US dollar could not go above yesterday's high of 1.3211. USD/CAD is now trading at 1.3171 faced with first resistance level at 1.3211, second level is seen at 1.3383 and major resistance is seen at 1.3600.

Main trend continues to be bearish on the long-term but if bulls get good indications for a potential appreciation of the US dollar, the pair will embark on its upward journey supported by strong US financials.

Chart: USD/CAD H4

Tuesday, February 7, 2017

EUR/USD Below Support

EUR/USD closed the European session in the red today after it went below support on the short-term. The pair dipped under 1.07, which was seen as immediate short-term support and is now still trading below that line.

If the pair continues in that direction, we might expect first support zone at 1.0619, second is seen at 1.0450 and major support is the lowest at 1.0338.

On the other hand, if bulls take the advantage of the dip, they can boost the price up to the latest high at 1.0825 thus forming a potential double top. If that does not hold, 1.09 is seen as major short-term target.

Whichever comes first will most likely be impacted by either Trump's success or Trump's failure to implement his new policies.

Chart: EUR/USD H4

If the pair continues in that direction, we might expect first support zone at 1.0619, second is seen at 1.0450 and major support is the lowest at 1.0338.

On the other hand, if bulls take the advantage of the dip, they can boost the price up to the latest high at 1.0825 thus forming a potential double top. If that does not hold, 1.09 is seen as major short-term target.

Whichever comes first will most likely be impacted by either Trump's success or Trump's failure to implement his new policies.

Chart: EUR/USD H4

USD/JPY Weakening

USD/JPY is trading in consolidation in today's session due to lack of impactful news that can give a direction to the pair. The latest developments in the pair show signs of weakness in the US dollar. The Trump rally came to an end just a bit over one month since it started on Nov 9 when Trump was elected President.

The pair made a staggering rally from 101.20 to 118.63 and it has been depreciating since then. Now the USD/JPY is trading at 112.03 and it appears that the trend will continue moving South unless we can hop on strong fundamentals.

The financial situation currently benefits the Yen as Trump makes a move to support a weak dollar. Even the Japanese former currency czar Eisuke Sakakibara said the dollar could fall below 100 yen by year end, but went on to say that Tokyo should not do any yen-selling as this might turn out to be counterproductive.

Char: USD/JPY H4

The pair made a staggering rally from 101.20 to 118.63 and it has been depreciating since then. Now the USD/JPY is trading at 112.03 and it appears that the trend will continue moving South unless we can hop on strong fundamentals.

The financial situation currently benefits the Yen as Trump makes a move to support a weak dollar. Even the Japanese former currency czar Eisuke Sakakibara said the dollar could fall below 100 yen by year end, but went on to say that Tokyo should not do any yen-selling as this might turn out to be counterproductive.

Char: USD/JPY H4

Monday, February 6, 2017

GBP/USD Lower

GBP/USD is trading lower today after an upbeat move to a high at 1.27. The pair started its way up from 1.19865 on Jan 16 and reached its highest point last week only to depreciate on weak UK data. GBP/USD is now trading at 1.2457 and it appears that it might attempt to reach lower levels.

First bear target is seen at 1.24, second target is seen at 1.2250 and major bear target rests at 1.2000.

Sterling bulls, however, do have a chance of going higher if the US dollar fails to keep up with Trump's policy implementations and investors and traders lose confidence in the potential impact of the developments. In that case, bulls will try to go above the resistance at 1.2750 and close at 1.28. Should they get there, the pair has a good outlook of going above 1.30 for the first time since October last year.

Chart: GBP/USD H4

First bear target is seen at 1.24, second target is seen at 1.2250 and major bear target rests at 1.2000.

Sterling bulls, however, do have a chance of going higher if the US dollar fails to keep up with Trump's policy implementations and investors and traders lose confidence in the potential impact of the developments. In that case, bulls will try to go above the resistance at 1.2750 and close at 1.28. Should they get there, the pair has a good outlook of going above 1.30 for the first time since October last year.

Chart: GBP/USD H4

AUD/USD Close To Resistance

AUD/USD has been going steadily to the upside in the past few weeks. The pair hit bottom on Jan 2 at 0.7163 and since then it's been rallying to current market price of 0.7663. AUD/USD is now trading slightly below the top which happened just a few points shy of 0.77 at 0.7695.

Main trend on the medium-term remains bullish while on the short-term we can expect the consolidation to continue. The pair will most likely trade sideways until one of the two sides gets a boost from financials and fundamentals.

Major resistance rests at 0.7750, while major support is seen way down to the starting point. Considering Trump's new policies, the pair might get into serious turbulence until the market digests Trump's approach to the economy.

Chart: AUD/USD H4

Main trend on the medium-term remains bullish while on the short-term we can expect the consolidation to continue. The pair will most likely trade sideways until one of the two sides gets a boost from financials and fundamentals.

Major resistance rests at 0.7750, while major support is seen way down to the starting point. Considering Trump's new policies, the pair might get into serious turbulence until the market digests Trump's approach to the economy.

Chart: AUD/USD H4

Friday, February 3, 2017

Market Analysis by ActivTrades

Analysis is the foundation of any market decision we ought to make. Two types of analysis exist in the financial market - fundamental and technical. There are strengths and weaknesses in both of them and it's important to know which one fits you better.

Fundamental analysis reflects markets news, while technical analysis reflects market prices. Combined they provide a clear picture of what is currently happening "on stage" and how this affects the "back stage", meaning that when a report comes out, for example, fundamental analysits base their decision on the news itself, while technical analysts base their decision on the price behavior alone.

An important element that helps distinguish a good broker is their involvement in the financial markets with both fundamental and technical analysis. For anyone interested, ActivTrades provides in depth daily market analysis that can give you an edge in your trading. Just visit HERE.

Fundamental analysis reflects markets news, while technical analysis reflects market prices. Combined they provide a clear picture of what is currently happening "on stage" and how this affects the "back stage", meaning that when a report comes out, for example, fundamental analysits base their decision on the news itself, while technical analysts base their decision on the price behavior alone.

An important element that helps distinguish a good broker is their involvement in the financial markets with both fundamental and technical analysis. For anyone interested, ActivTrades provides in depth daily market analysis that can give you an edge in your trading. Just visit HERE.

Thursday, February 2, 2017

Gold Up Amid Uncertainty

Gold is trading at a 2.5 month high in today's session amid uncertain times in the US economy. More specific, the Trump wave seems to be wearing off and now markets would need something fresh to stir the environment and create volatility.

The precious metal reached a high of $1,224 and is now trading at $1,217. If the trend keeps on going we might see Gold above immediate resistance at $1,230 to a probable bull target at $1,300. All eyes are now on the US economy and the latest NFPs and Jobs report scheduled for tomorrow 8:30EST.

Should we get bad news, Gold is destined to shine again. High volatility can be expected tomorrow in the Gold and currency market as this would be the first major report under Trump's administration.

Chart: XAU/USD D1

The precious metal reached a high of $1,224 and is now trading at $1,217. If the trend keeps on going we might see Gold above immediate resistance at $1,230 to a probable bull target at $1,300. All eyes are now on the US economy and the latest NFPs and Jobs report scheduled for tomorrow 8:30EST.

Should we get bad news, Gold is destined to shine again. High volatility can be expected tomorrow in the Gold and currency market as this would be the first major report under Trump's administration.

Chart: XAU/USD D1

Labels:

chart,

commodities,

commodity,

dollar,

forex,

fundamental analysis,

gold,

investing,

rozen,

speculation,

trade,

trader,

trading,

trend

Wednesday, February 1, 2017

USD/JPY Makes a Move

USD/JPY has been trading with high volatility for the past few weeks.

The pair made a low yesterday of 112.08 on a weaker US dollar and is now

back at 113.47. Lately, it has been difficult to predict what the

currency pair is going to do as we saw a lot of uncertainty in markets

thus causing the pair to roam volatile.

Now it looks like the US dollar is gaining strength again so we might expect the move to continue higher. If this is the case, bulls might try to reach first target level at 113.93 and major short-term target at 115.13.

On the other hand, negative US dollar news will impact the pair in favor of the Japanese Yen and this will make way for first bear target at 112.20 and major short-term target at 111.12.

Chart: USD/JPY H4

Now it looks like the US dollar is gaining strength again so we might expect the move to continue higher. If this is the case, bulls might try to reach first target level at 113.93 and major short-term target at 115.13.

On the other hand, negative US dollar news will impact the pair in favor of the Japanese Yen and this will make way for first bear target at 112.20 and major short-term target at 111.12.

Chart: USD/JPY H4

Subscribe to:

Posts (Atom)